The 47th GST Council meeting resulted in revisions to the GST rates on stationery items, impacting products like pencil sharpeners, paper knives, and printing materials. The rates were increased from 12% to 18% to address tax structure issues. Effective from 18th July 2022, some exemptions were granted, while a subsequent meeting saw a rate cut for pencil sharpeners.

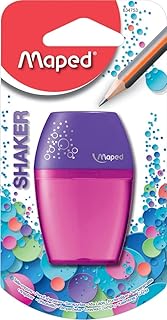

Stationery items in India are subject to varying GST rates, with the recent changes affecting specific products under Chapter 96 of the HSN code. While most items fall under this chapter, exceptions like slates, slate pencils, and chalk sticks are exempt from GST. The 47th GST Council raised rates on certain stationery items, later restoring the original rate for pencil sharpeners.

Notably, paper-based stationery products are categorized under HSN codes 48 and 49, attracting different GST rates. The 47th GST Council meeting removed exemptions on printed items like maps and charts, subjecting them to a 12% rate. The changes also impacted categories like uncoated paper, kraft paper, and various paperboard materials.

Metal-based stationery items, including paper trays and pen stands, are classified under HSN code chapter 83 and are subject to an 18% GST rate. However, a decision at the 49th GST Council meeting aims to reduce the rate for pencil sharpening machines from 18% to 12%.

Printing services, falling under chapters 48 and 49, are part of chapter 99 for manufacturing services. The GST rates for printing services vary, with job work related to printing attracting 5% or 12% GST, depending on the specifics. A recent Authority for Advance Rulings decision clarified the GST applicability on printing certain stationery items.

Input tax credit (ITC) can be claimed on stationery items under GST if they are used for business purposes and not part of the negative list. However, the recent GST rate hike on stationery items is anticipated to impact retail prices, potentially leading to a 4-6% increase, particularly affecting low-income households.

In conclusion, the evolving landscape of GST on stationery products reflects the government’s efforts to streamline tax structures and address industry-specific challenges. These revisions impact manufacturers, retailers, and consumers alike, underscoring the need for businesses to stay informed and adapt to changing tax regulations.

📰 Related Articles

- Queensland Land Valuations Surge, Expect Higher Council Rates

- Coffee Prices Surge Globally, Impacting Consumers and Businesses

- AMP Bank Raises Rates Amid Shifting Home Loan Market

- World Leaders Forge Trade Partnerships, Impacting Global Economic Landscapes

- Windale Hub Council Meeting to Address Climate Resilience and Family Strategy

📚Book Titles

- Blueprint to Comprehensive Wellness: Strategize Your Nutrition, Fitness, and Mental Health

- Ghost Ships Unleashed: The Terrifying Truths of History’s Most Haunting Maritime Mysteries!

- Blueprint to Comprehensive Wellness: : Strategize Your Nutrition, Fitness, and Mental Health

- Conflict Resolution in the Workplace Training Manual